- brain nudes

- Posts

- 8-Year, $400M VC Thesis Autopsy

8-Year, $400M VC Thesis Autopsy

What the market proved after nearly a decade of experimentation and why the thesis reached its natural ceiling.

Executive Summary

Across eight years (2017–2025), more than $400M in venture capital from dozens of top-tier firms flowed into roughly 12–15 startups to prove one idea:

That everyday consumers could make ads for money and that this could scale into a new advertising channel.

Every variant was funded.

Every angle was tested.

Every configuration was tried.

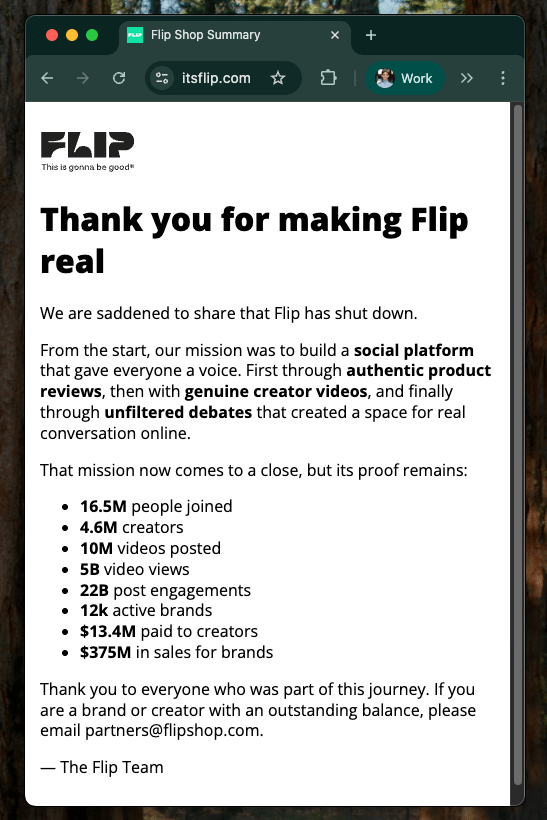

In August 2025, Flip Shop — the largest, most complete, and most capitalized expression of the thesis — abruptly shut down.

Flip’s shutdown made something undeniable:

This entire class of business models had a structural market cap and that cap sat below venture-scale thresholds.

Not mistimed.

Not misexecuted.

Capped.

This is the category-level autopsy: the final, settled closure.

As a founder funded to pursue this thesis, this analysis is what finally makes the model legible, explainable, and closed.

This is not a postmortem of a company.

It is a postmortem of a venture thesis.

The Flip Distinction: Physics vs. Execution

Before going further, one line must remain sharp:

Flip did not fail because of execution.

If anything, Flip prolonged the thesis far beyond what any team (including mine) could have achieved.

Best-funded

Best-designed

Most technically complete

Most scaled

Most institutionally supported

If my early Swaypay experiments were kindergarten-level, Flip’s were PhD-level.

And it is precisely because they executed at that level that we can now say, definitively:

The thesis that everyday consumers could make ads for money had a structural ceiling and Flip revealed that ceiling for the entire ecosystem.

Their scale allowed the underlying physics to fully surface.

And because they reached that endpoint, the market (myself included) can finally have clarity and closure.

I’m genuinely grateful for how far they pushed the frontier.

The ~$400M Venture Bet

The bet rested on a single conviction:

If you financially incentivize everyday consumers, their natural behaviors (posting, reviewing, recommending, livestreaming) can be converted into predictable, performance-grade ad creative — creating a scalable new advertising channel.

It was a supply-side bet: that “consumer-created content” could behave like an industrialized advertising asset class.

Scope Clarity: Category → Subcategory → Venture Thesis

It’s critical to separate the layers:

Category: Creator-led advertising (large, growing)

Sub-Category: UGC advertising (foundational to modern performance media)

Venture Thesis: Rewarded Consumer UGC — the conviction that everyday people can make ads for money, at scale

This analysis is about the thesis, not the category.

Creator-led advertising is strong.

UGC is everywhere.

Influencer media keeps expanding.

But the specific venture-backed behavioral model reached its ceiling.

Flip revealed that ceiling.

Venture Timeline (2017–2025)

This wasn’t a fringe idea. It attracted institutional belief across the capital stack:

Tier 1 VCs: Benchmark • Lightspeed • CRV • Bessemer • Greycroft

Seed Specialist + Thesis-Based VCs: BBG Ventures • Pear • Rise of the Rest

Corporate VCs: Walmart • Visa • Barclays • BMO • Anthemis

Sequoia and Andreessen Horowitz, the apex consumer/social investors, did not fund this thesis. In hindsight, this aligns with their pattern-recognition around models whose supply cannot be standardized.

Year | Events | Outcome |

|---|---|---|

2017–2019 | Early social commerce + consumer incentive experiments seeding | Hypothesis emerges |

2019–2020 | Flip raises $6.8M seed; Swaypay raises pre-seed | “Consumers could be creators” wave |

2021–2022 | Swaypay, Kale, Bounty raise seed; Pearpop, Popshop raise growth capital | Institutionalization |

2023–2024 | Flip pulls ahead, bringing raise to $300M+ | Mega-scale stress test |

2025 | VCs stop funding | Market returns to equilibrium |

🛑 August 2025 | Flip shuts down | Category ceiling revealed |

Thesis Participants (Representative Bets)

A four-question litmus test determines whether a model sits inside the rewarded-UGC thesis:

Does it rely on consumers behaving like professional creators?

Does it rely on blurring or softening ad-disclosure laws?

Does it rely on “organic-looking authenticity” as a performance driver?

Is creative variance unpredictable at scale?

If yes to all four → inside the thesis → inside the failure pattern.

1. Mega-Scale Stress Test

Company | Capital Raised | Model | Status |

|---|---|---|---|

Flip Shop | $300M+ | Paid shoppers to create shoppable video reviews inside a TikTok-meets-Amazon app | 🛑 Shut down in August 2025 |

2. Creator-Challenge Variant

Company | Capital Raised | Model | Status |

|---|---|---|---|

Pearpop | $34M | Paid everyday people to participate in creator-style challenges | 🟠 Exited venture path; now agency model |

3. Livestream Shopping Variant

Company | Capital Raised | Model | Status |

|---|---|---|---|

Popshop Live | $20M+ | Paid regular consumers to host livestream shopping | 🛑 Shut down |

4. Incentivized Consumer UGC Cluster

Company | Capital Raised | Model | Status |

|---|---|---|---|

Swaypay → Disclosure Facts | $4.2M | Cashback-for-posting → incentivized consumer UGC | 🟢 Pivoted out of thesis in 2023 |

Bounty | $5M | Pay-per-UGC TikTok videos | 🛑 Shut down |

Kale | $3.9M | Review-for-rewards | 🟠 Exited venture path; agency |

Billo | $2M | UGC-for-hire marketplace | 🟡 Stable SMB; not venture-scale |

Why Investors Funded the Thesis

⏱️ The $400M bet emerged from a unique collision of two curves:

1. Consumer Behavior Curve

A historic shift:

Creation normalized

Platforms frictionless

Everyday output looked industrializable

Gen Z/Alpha hyper-performative

The leap from:

“People post for free” → “People will post more for money”

felt inevitable.

2. Venture Liquidity Curve

2020–2022 ZIRP conditions:

Near-zero interest rates

Accelerated fund deployment

Pressure to underwrite new consumer models

Capital flowing horizontally across variants

This thesis only received $400M of testing because it sat at the intersection of:

A. unprecedented performative consumers

B. unprecedented liquidity

No other period in history would have produced this level of experimentation.

The 6 Core Assumptions And Why Each Failed

1. UGC behaves like inventory (STRUCTURAL CAP)

This is the deepest, most fatal assumption.

The entire thesis required non-professional consumer output to behave like a reliable, inspectable, predictable advertising asset class.

It didn’t.

This is the foundational failure, because if UGC cannot function as inventory, then:

supply can’t be standardized

quality can’t be predicted

outcomes can’t be repeatable

economics can’t compound

incentives can't industrialize creativity

💀 If UGC isn’t inventory, nothing else works.

This is the root failure everything else cascades from.

2. Incentives industrialize creativity (BEHAVIORAL CAP)

This is the next most important because the model required consumers to behave like:

creative workers

consistently

on command

at scale

with ad-quality output

But incentives broke behavior instead of standardizing it.

This is the behavioral hard limit.

It is the creative equivalent of “toddlers → lawyers.”

💀 If incentives can’t industrialize creativity, supply can never scale.

3. Authenticity survives payment (PERFORMANCE CAP)

Once people are paid, the content:

loses authenticity

loses organic cues

invites skepticism

triggers algorithmic suppression

This destroys the performance driver of UGC itself.

Paid UGC stopped being UGC.

This is where the performance delta collapses, and it is the moment the arbitrage became imaginary.

💀 If authenticity collapses, paid UGC underperforms — permanently.

4. Legally viable at scale (REGULATORY CAP)

This is the assumption investors never evaluated and the one our vantage point from Swaypay (now Disclosure Facts) makes uniquely clear:

For rewarded UGC to perform, it had to look organic.

For it to be compliant, it had to be clearly and conspicuously disclosed.

Those two requirements are structurally, legally, and mechanically incompatible.

This is where the thesis collides with hard-law boundaries, not just behavioral or platform limits.

💀 If disclosure kills performance, the model cannot be both compliant and effective.

There is no regulatory path that preserves both.

This lands at #4 only because the upstream behavioral physics already failed but regulation is what cements the impossibility.

5. The economics will hold (ECONOMIC CAP)

This is the visible failure VCs eventually accepted:

CAC was unstable

ROAS variance high

fraud pressure rising

payout ladder inflationary

ad value unpredictable

But the economic failure is a symptom, not a cause.

It was downstream of the first four failures.

💀 If the underlying behaviors don’t compound, the economics can’t.

6. Habitual posting → scalable supply (INPUT CAP)

This is actually the least important failure — not because it didn’t matter, but because:

Even if supply had scaled…

Even if posting increased…

Even if you had infinite UGC…

The physics above (1–5) still kill the model.

The mistake was assuming:

“People post for free → they will post more for money.”

No:

They posted worse, less authentically, and less predictably.

But this failure sits at the bottom because it was an input problem, while the others were systemic impossibilities.

💀 Even infinite supply wouldn’t have saved the thesis.

Note: UGC Format vs. UGC Thesis

UGC-as-format is thriving.

UGC-as-a-behavior is universal.

UGC-as-paid-media is foundational.

But UGC-as-a-venture-thesis — incentivizing everyday consumers to produce ad creative — reached its ceiling.

UGC Business Types by Venture-Scalability Ceiling

Business Type | Archetype | Ceiling | Physics |

|---|---|---|---|

Viable SMB | UGC-for-hire, influencer agencies, rewards apps | 8-figure | Labor-bound, linear, no compounding |

Mid-Size Venture | Creator workflow SaaS | 9-figure | Tools ≠ distribution or compliance |

Large-Scale Venture | Ad compliance infra, programmatic creator media layers | 10-figure | Infra becomes standard layer |

Rewarded UGC sat in the first bucket.

The 10 Limiting Vectors

(Shortened + tightened)

The thesis had a natural limit: incentivized consumer content never behaved like a scalable advertising asset class.

Behavioral physics broke: payments collapsed authenticity and triggered algorithmic suppression.

UGC is a behavior, not a commodity: you can’t standardize taste, humor, timing, or cultural fluency.

Non-professionals ≠ creative workforce: the model needed lawyer-quality work from toddlers.

TikTok Shop ≠ validation: creator commerce ≠ consumer UGC commerce; platform privilege ≠ thesis truth.

The arbitrage never existed: predicted spreads never materialized; ROAS variance killed scalability.

Platform physics killed it: coordinated, paid consumer posting triggers suppression across ranking systems.

Compliance made it non-viable: if you pay, it’s an ad; once disclosed, performance collapses.

Flip revealed the ceiling: best execution + most capital + first-party app control still hit the boundary.

AI-UGC isn’t a successor: it’s a separate, prohibited category defined by fabricated testimonials and deception.

Closure

Flip’s shutdown wasn’t a collapse.

It was the natural cap of a venture thesis embedded inside a much larger, healthy category.

The model produced everything it could:

predictable behavior never scaled

creative variance never stabilized

compliance costs never inverted

unit economics never compounded

algorithmic suppression never lifted

In venture terms: the thesis reached its market cap.

When a thesis hits its cap, the market stops funding it.

Closure didn’t come from shutdowns.

It came from the physics revealing the boundary.

The ceiling was the verdict.

A Brief Note of Gratitude:

The only reason the ecosystem reached clarity is because thousands of founders, creators, operators, and investors pushed this frontier with real capital and conviction for a decade. This collective effort allowed the underlying physics to fully reveal themselves.

I’m grateful to have been one of the founders entrusted to explore this terrain.

And especially grateful for Flip, whose scale drew the boundaries of where the thesis could and could not go.

This is the maximal clarity.

Only at maximal clarity can an autopsy be performed.

And the autopsy closes the thesis.

Kaeya